EI Payday Loans Canada

Unforeseen situations and emergencies can happen to anyone. Even if you are on EI, a cash loan may need to cover sudden urgent expenses. If you are looking for EI loans online, you have options, no matter what your employment status or credit score. EI Payday Loans Canada Online, for those who need fast approval and funding. But these come with extremely high-interest rates, so an alternative that can also accept EI is installment loans.

What is Employment Insurance (EI) in Canada?

While unemployed workers look for employment or upgrade their skills, the Employment Insurance (EI) program provides temporary income support. EI also has a special benefit for workers who take time off work due to specific life events:

- Critical sickness leave

- Pregnancy leave

- Parental leave for caring for a new-born or newly adopted child

- Caring for a critically ill or injured person

- Taking care of someone who is seriously ill and has a substantial risk of death

How does EI work for unemployed people?

Canadians who are available to work but lose their jobs due to lack of work, seasonal, or mass layoffs. Employment Insurance (EI) provides regular financial benefits to individuals who can work, but can't find a job.

The Canada Employment Insurance Commission (CEIC) plays a leadership role in overseeing the EI program. CEIC is also responsible for determining the annual premium rate for EI. What CEIC works for EI service:

- To provide timely and accurate EI benefit payments and services

- To support EI clients through each stage of the service delivery process by:

- Providing benefit information.

- Responding to inquiries.

- Assisting employers.

- Processing claims and providing the means to appeal decisions.

- Conducting client authentication and identification.

- Preventing, detecting, and deterring fraud and abuse.

What are the advantages of EI benefits for jobless people?

Employers who lose their jobs for reasons outside their control are eligible for Employment Insurance (EI) benefits.

Employer's insurance (EI) sickness benefits provide up to 15 weeks of financial support to employees who are unable to work due to illness. A maximum of $638 a week is possible if you receive 55% of your earnings, which is dependent on local unemployment rates.

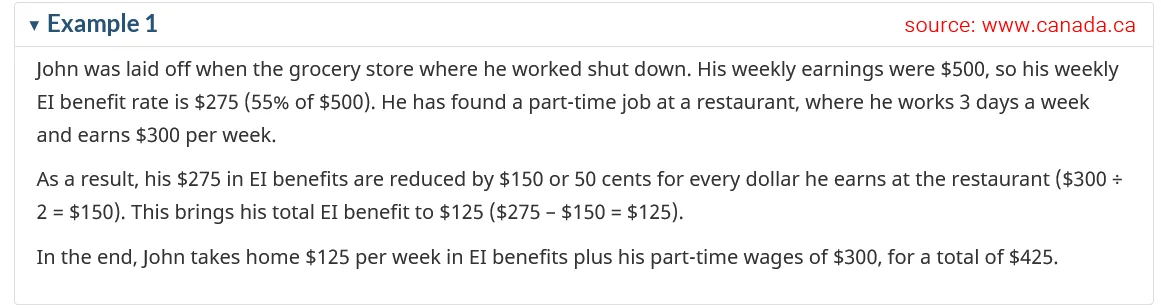

How does working affect your EI claim?

You qualify for any type of EI benefit even if working. If you work part-time while receiving Employment Insurance, your benefit will reduce to 50% for each dollar you earn by working after a benefit claim. However, if you work full-time a week, you are not eligible to receive EI benefits, no matter how much you earn.

looking for a EI Benefits Payday Loans ?

How to apply for EI Benefits in Canada?

Always apply for EI benefits as soon as you stop work or take leave from your job. You can apply for benefits even if you have not yet received employment records from your employer. If you delay filing your claim for benefits by more than four weeks after your last day of work, you may lose government assistance.

Before starting your application →

Ensure you have the following information when you are applying for Employment Insurance (EI):

- Social insurance number (If your SIN starts with a 9, you need to show proof of your immigration status and work permit)

- One of your parents' last names at birth

- Mailing and residential addresses, including the postal codes

- Banking information to sign up for the direct deposit

- Names, addresses, dates of employment, and reason for separation

- Explanation of Facts (You quit the job or were fired in the past 52 weeks)

- Last 52 weeks or since the last EI claim, the highest paying week information to calculate the profit rate

How to reactivate an existing claim?

If you want to reactivate an existing claim, you will need to provide the following details:

- Salary received in the week preceding the deduction (Sunday to the last day of work), including commission.

- Any other amount you received or will receive, such as:

- Vacation pay

- Severance pay

- Pension payments

- Pay instead of notice

- Other money

Source: Canada.ca

FAQs: - You Ask Questions We Will Answer About EI Payday Loans

Are EI benefits considered as income by payday lenders?

Yes! Find a payday lender who accepts EI as a source of income if you want to qualify for an EI payday loan in Canada. A payday loan for EI recipients can be applied for online or in-store, you just need to be able to prove that you receive EI.

Can I get EI payday loans in Canada?

Payday loans are legal (under section 347.1 of the Criminal Code) in Canada, and they will not affect your EI benefits. Some lenders accept Employment Insurance as a valid source of income, so receiving EI could help you qualify for a payday loan.

Should I get a payday loan or installment loan using my EI?

If you're looking for loans for the unemployed on benefits in Canada, you have online options – EI payday loans and Installment loans for EI. In general, instalment loans are faring better than payday loans when compared to these two types of EI loans. Both options are indeed costly, but online installment loans are more flexible in terms of payment and give you more time to recover your finances.

How do I apply online for EI payday loans in Ontario?

You live in Ontario or any of a Canadian Province, wherever payday loans with government benefits are legal. To apply for an EI loan online, the following things have to be taken care of:

- Check your credit score, because with a credit score below 660 you have to face higher interest rates.

- Find the most competitive rates and terms by comparing at least three to four lenders.

- Make sure you meet the eligibility criteria before applying.

- Fill out the application once you have found the right EI loan.

- Decide between an instant payday loan or an easy instalment loan.

- Get ready your documents (such as bank details and a government-issued ID) for verification.

- Review the repayment schedule, total cost of the loan, and additional charges before signing the contract.

Can I get a line of credit on EI?

Yes! A line of credit is possible on EI in Canada, but it depends on who it is. EI is accepted by some lenders as a valid source of income, but not by others.

What benefits of EI Payday Loans Online for me as an Unemployed?

You can apply for a loan online and receive a decision almost instantly when you fill out simple forms. In this way, you can gain access to funds 24/7 without having to go to a loan shop. Upon approval, you can receive the money within 2 minutes via email transfer. Anyone can apply for an EI payday loan in Canada, no matter what credit score they have.

We help to find unsecured and unrestricted EI payday loans, which mean that the money you borrow can be used in any way you choose. No refusal payday loans not only accept employment insurance payments but also allow other income sources (CPP, Private Pension, WCB, CTC, or Non-Government Disability benefits).

Can I get a payday loan, if receiving EI benefits in Manitoba?

You can receive an online payday loan in Manitoba while on Employment insurance. The process is the same, find a payday lender that accepts EI benefits as a source of regular income.

Can an unemployed with bad credit get an EI loan?

EI Payday Loan is only for those individuals who have lost their employment due to some unavoidable reason. If you are unemployed, then your credit score may be also bad. Don't worry if you need cash urgently. Bad credit, or no credit at all – anyone can apply for a high approval rate EI Payday Loan.

Do EI payday loans require a credit check?

No credit check is required. To be eligible for EI Payday Loan no credit check, you'll need to be at least 18 years of age with a steady source of income and a checking account.

Is it hard to get approved for a payday loan in Alberta?

Getting a payday loan in Alberta is very simple even with EI income. There are just a few simple steps involved in the procedure. Before starting your easy application process, please visit how it works. In this page you will learn more about eligibility criteria and the required documents.

What is the maximum amount I can borrow with emergency cash loans for unemployed Canada?

In Canada, as social welfare recipients, you can apply a maximum of $1,500 with emergency cash loans for unemployed.